What Is A B3 Credit Rating: A Comprehensive Guide

Credit Ratings: What Are They, Who Issues Them, And What Do They Mean?

Keywords searched by users: What is a B3 credit rating moody’s b3 rating definition, moody’s b3 rating equivalent to s&p, b rating meaning, b- credit rating meaning, bbb credit rating, b3 meaning in chat, b3-pd probability of default rating, Moody’s rating Vietnam

Is B3 A Good Credit Rating?

Is a B3 credit rating considered good? The B3/B- rating falls within the highly speculative category of credit ratings, indicating a higher level of risk associated with investments in bonds with this rating. It is positioned just one notch above C-rated bonds, which are considered the riskiest among junk bonds. Although the terminology may not sound appealing, junk bonds, also referred to as high yield bonds, manage to attract a substantial number of investors due to their potential for higher returns. Investors willing to take on more risk in pursuit of greater yields often consider bonds in this category.

What Is The B3 Rating?

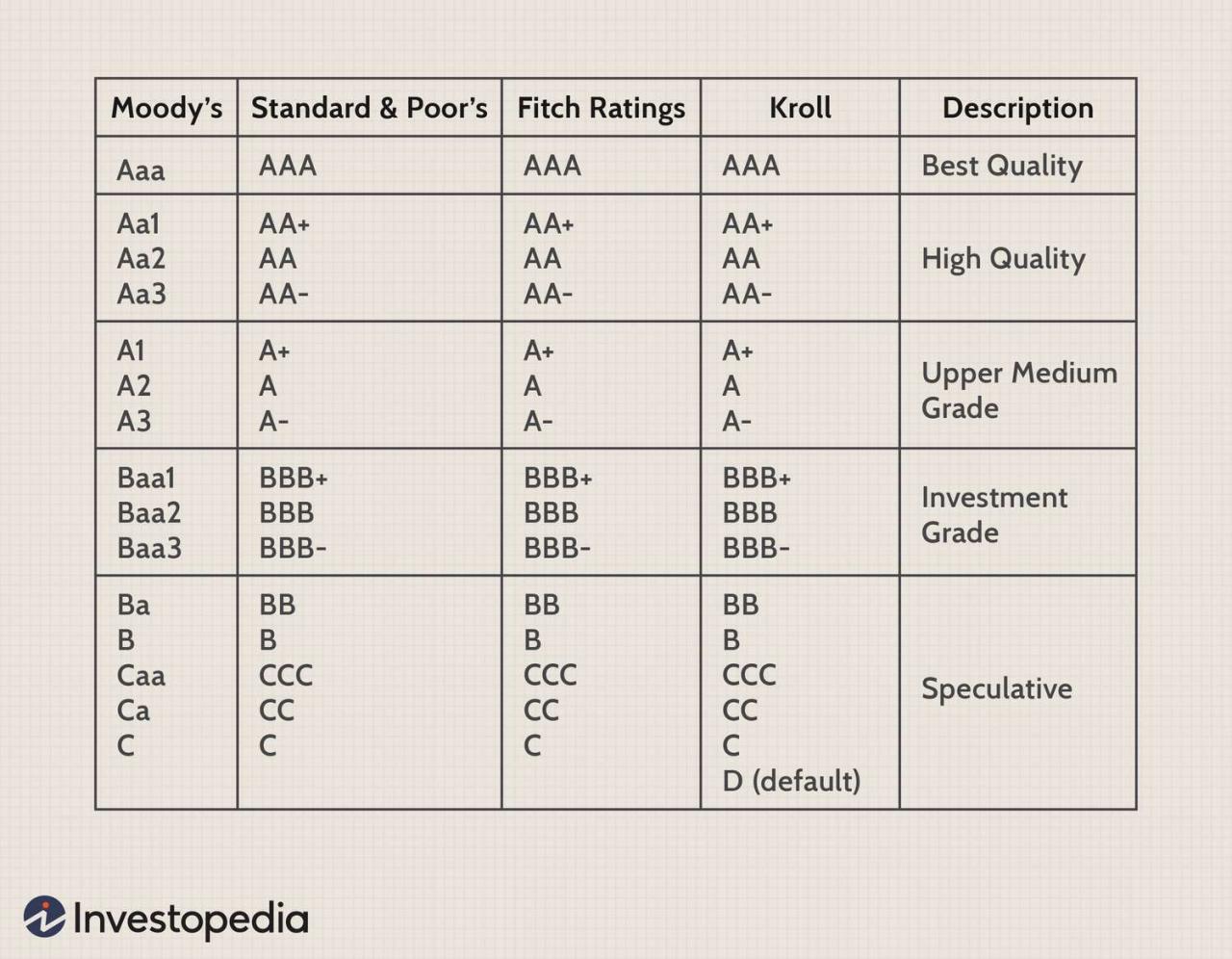

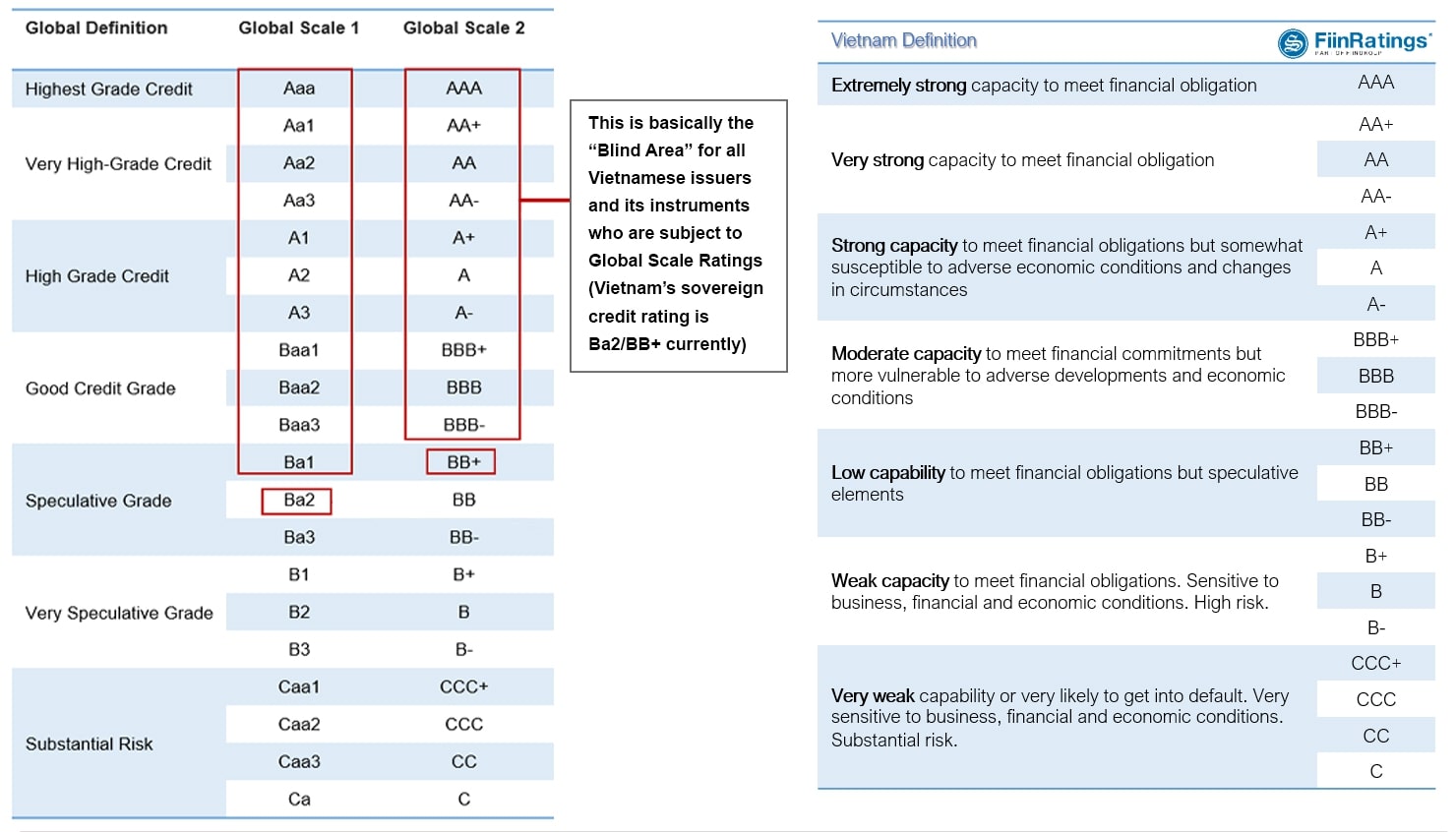

The B3 rating is a crucial component of credit rating codes and classes used by Moody’s to evaluate the creditworthiness of entities. This rating provides valuable insights into the financial stability and risk associated with long-term and short-term investments. Specifically, B3 signifies a credit rating that falls into the category of “Not prime,” indicating that the investment is considered highly speculative. This means that there is a substantial level of risk associated with investments carrying a B3 rating, making them potentially less secure compared to higher-rated investments. To provide additional context, Moody’s employs a range of ratings to assess credit risk, and B3 is just one of several possible ratings within their system, with each rating reflecting a different degree of credit risk. This information is essential for investors and financial analysts to make informed decisions when evaluating investment opportunities.

What Is B Level Credit?

What does “B level credit” refer to? “B1/B+” credit ratings are part of a broader set of non-investment grade credit assessments, often colloquially referred to as “junk” ratings. These ratings can be applied to various financial instruments, including companies, fixed-income securities, or floating-rate loans (FRNs). Essentially, they indicate that the entity being rated carries a higher level of risk, which translates to an elevated likelihood of defaulting on its financial obligations. As of August 18, 2023, this information helps investors and creditors gauge the creditworthiness of these entities more effectively.

Share 24 What is a B3 credit rating

Categories: Collect 96 What Is A B3 Credit Rating

See more here: triseolom.net

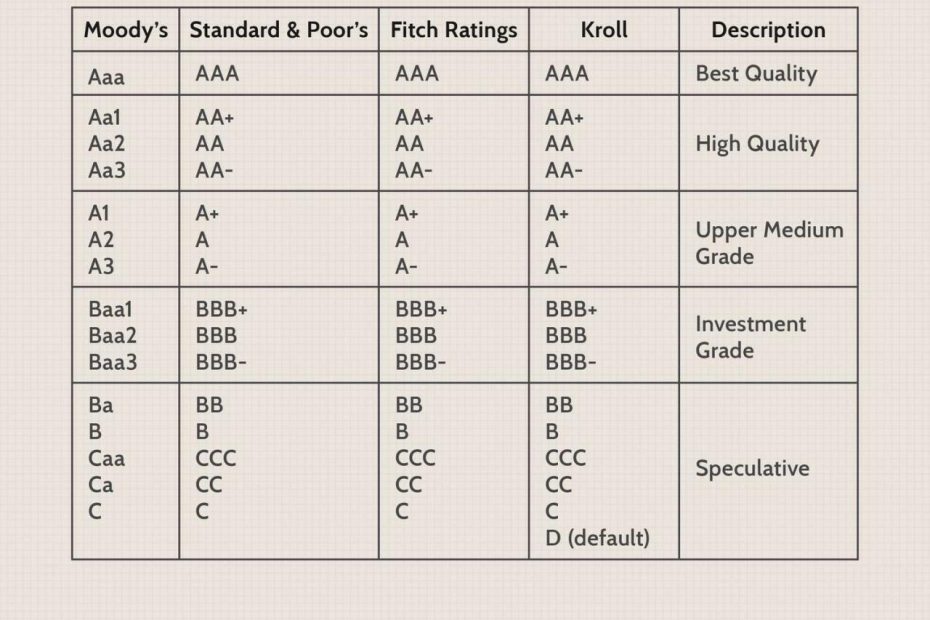

Moody’s assigns its B3 rating for “obligations considered speculative and subject to high credit risk.”1 Entities that receive this rating may be experiencing financial instability or hold inadequate cash reserves relative to their business needs, debt or other financial obligations.The B3/B- rating falls under the “highly speculative” category, placing it just a step away from C-rated bonds, the riskiest of junk bonds. Despite their unappealing nomenclature, junk bonds, also known as high yield bonds, attract a significant number of investors.B1/B+ are one of several non-investment grade credit ratings (also known as “junk”) that may be assigned to a company, fixed-income security, or floating-rate loan (FRN). These ratings signify that the issuer is relatively risky, with a higher-than-average chance of default.

| Moody’s | Rating description | |

|---|---|---|

| Long-term | Short-term | |

| B3 | Not prime | Highly speculative |

| Caa1 | Substantial risks | |

| Caa2 | Extremely speculative |

Learn more about the topic What is a B3 credit rating.

- B3/B-: What it is, How it Works, Investment Risk – Investopedia

- B-/B3 Credit Ratings: An Insight into High-Risk Bonds – Tickeron

- Bond credit rating – Wikipedia

- B1/B+: What It Is, How It Works, Special Considerations – Investopedia

- B2 Definition – Nasdaq

- Fitch Affirms B3 S.A.’s ‘BB’/’AAA(bra)’ Ratings; Outlook Stable

See more: https://triseolom.net/category/world blog